Automate Report Generation and Data clarification using AI and ChatGpt

Creating or showcasing reports, for any purpose - business, personal, or data evaluation - often demands significant time and effort. Whether gauging your brand's impact, understanding your financial situation, or probing a specific dataset, having the right instruments is essential.

Not only, having the possibility to read advanced data and discover opportunities around the number, especially in Financial datasets.

This underscores the significance of the ChatGPT code interpreter, a potent tool designed to streamline the creation of comprehensive reports from input data.

Think about the impact of presenting meticulously crafted, data-centric reports to your office superiors or business peers, by leveraging ChatGPT's code analysis features, you can craft detailed reports that shine a light on the nuances of your data.

What is a Chatgpt code interpreter?

ChatGPT code interpreter is a tool that can generate detailed reports from uploaded data, it can be used for business, personal, or data analysis purposes.

The interpreter can help in measuring brand performance, gathering insights about personal finances, or delving into specific datasets providing insightful conclusions and projections based on the data.

The tool can convert PDFs to CSV files for data extraction and various features like file downloads, automating data entry, and adding it to Visual Code Studio for AI coding identifying hidden trends and patterns to enhance sales strategies helping in cost management and optimization by identifying monetary leaks and potential areas for cost-cutting.

Not only: AI can help teams to develop decisions for faster application and coding.

I use this functionality daily, I will show the potential, that always needs its control and what we need to extract.

After adding my csv dataset (Ethereum prices using the Google Finance formula) I start to create the report:

Below is the entire Conversation with the AI, in H2 all my questions.

Obviously, it is fundamental to know, as all the AI, what and how to make the right question!

Plot the price of Ethereum with the average line, order by date

Got it. I'll compute the average price of Ethereum over the entire timeframe and then plot a horizontal line representing this average alongside the daily closing prices.

The blue line represents the daily closing price of Ethereum over time.

The dashed red line represents the overall average closing price for the entire timeframe.

This provides a clear visual representation of how the daily prices compare to the overall average.

Plot the price with the average polynomial of the last 104 weeks

Alright, if I understand correctly, you're looking to fit a polynomial regression line to the Ethereum price data from the last 104 weeks (which is equivalent to the last 2 years) and then plot this line alongside the actual prices.

To achieve this:

I'll first extract the data for the last 104 weeks.

I'll fit a polynomial regression model to this data.

I'll plot the actual prices and the polynomial regression line on the same graph.

Let's start by filtering the data for the last 104 weeks.

We've successfully filtered the data for the last 104 weeks.

Next, I'll fit a polynomial regression model to this data. Typically, a degree of 2 (quadratic) or 3 (cubic) is chosen for polynomial regressions, unless there's a specific reason to go higher. For this demonstration, I'll use a quadratic polynomial (degree 2). If you'd like a different degree, please let me know.

Let's proceed with fitting the polynomial regression model.

The polynomial regression model has been fitted to the data, and predictions have been generated using this model.

Next, let's plot the actual Ethereum prices alongside the polynomial regression line for the last 104 weeks.

Here's the graph:

The blue line represents the actual Ethereum prices over the last 104 weeks.

The dashed red line represents the polynomial regression fit (quadratic) over the same period.

Aggregate the price by months, of the last 10 years, insert the average tendency

I'll filter the data for the last 10 years.

I'll aggregate the prices by month, computing the average for each month.

I'll fit a polynomial regression model to this aggregated data to get the average tendency.

I'll plot the aggregated monthly prices alongside the polynomial regression line.

Let's start by filtering the data for the last 10 years and aggregating the prices by month.

We've successfully aggregated the Ethereum prices by month for the last 10 years.

Next, I'll fit a polynomial regression model to this aggregated data to determine the average tendency, and then plot the aggregated monthly prices alongside the polynomial regression line.

Here's the graph:

The blue line with markers represents the average Ethereum prices aggregated by month over the last 10 years.

The dashed red line is the polynomial regression fit (quadratic) showing the average tendency over the same period.

Plot bars graph aggregating weekly prices of the last 200 weeks, adding linear forecasting for the next 104 weeks

To accomplish this:

I'll filter the data for the last 200 weeks.

I'll aggregate the prices by week, computing the average for each week.

I'll fit a linear regression model to this aggregated data.

I'll make predictions using this model for the next 104 weeks to create a linear forecast.

I'll plot the aggregated weekly prices as bars and the linear forecast as a line on the same graph.

Let's start by filtering the data for the last 200 weeks and aggregating the prices by week.

We have successfully aggregated the Ethereum prices by week for the last 200 weeks.

Next, I'll:

Fit a linear regression model to the aggregated weekly data.

Generate linear forecasts for the next 104 weeks.

Plot the aggregated weekly prices as bars and overlay the linear forecast on the graph.

Here's the graph:

The blue bars represent the average Ethereum prices aggregated by week over the last 200 weeks.

The dashed red line represents the linear forecast for the next 104 weeks.

This visualization provides insight into the weekly average Ethereum prices over the past 200 weeks and a linear projection for the upcoming 104 weeks.

Considering a dataset of the last 30 days

.how much is the standard deviation

.the value of the mean

.the value of the sd

.plot a graph

Filter the data for the last 30 days.

Compute the standard deviation and mean of the prices over these 30 days.

Plot the Ethereum prices along with lines representing the mean and mean ± standard deviation.

Let's start by filtering the data for the last 30 days.

Now that we have filtered the data for the last 30 days, I'll compute:

The standard deviation of the prices.

The mean of the prices.

For the Ethereum prices over the last 30 days:

The standard deviation is approximately $11.97

The mean value is approximately $1453.68

Next, I'll plot the Ethereum prices over these 30 days, along with lines representing the mean and mean±standard deviationmean±standard deviation.

Here's the graph for Ethereum prices over the last 30 days:

The blue line represents the daily Ethereum prices.

The dashed red line represents the mean price over the 30 days.

The dashed green lines represent one standard deviation above and below the mean.

The area between the green lines covers approximately 68% of the data points if the distribution is normal. This visualization provides insight into the variation and central tendency of Ethereum prices over the past month.

How much decreased or increased the price in the percentage of Ethereum from day 1 till today?

I'll get the price on day 1.

I'll get the price on the latest date (today).

I'll use the formula:

The price of Ethereum has increased approximately 14,772.76% from day 1 until today.

This means that if you had invested in Ethereum on day 1, the value of your investment would have increased by almost 148 times by today.

How much are the changes in the prices of the last

-3 years

-2 years

-1 years

-12 months aggregated?

3 years ago

2 years ago

1 year ago

12 months aggregated (This will be the sum of the monthly percentage changes over the last 12 months)

Here are the percentage changes in the price of Ethereum for the specified durations:

Over the last 3 years: An increase of approximately 335.04%

Over the last 2 years: A decrease of approximately 38.31%

Over the last 1 year: A decrease of approximately 8.89%

Aggregated over the last 12 months: An increase of approximately 4.21%

Note: The aggregated percentage change over the last 12 months is derived from the cumulative product of the monthly percentage changes, which can be interpreted as the compounded growth rate over that period.

How much could I have accumulated if invested 1000£ 4 years ago?

To determine how much you could have accumulated if you invested £1,000 in Ethereum 4 years ago, we'll:

Find the Ethereum price 4 years ago (from the last available data point in the dataset).

Calculate the amount of Ethereum you could have purchased with £1,000 at that time.

Calculate the current value of that Ethereum based on the most recent (or last) closing price in the dataset.

If you had invested £1,000 in Ethereum 4 years ago (based on the prices provided in the dataset), the value of your investment today would be approximately £9,356.20.

This represents a significant return on your initial £1,000 investment, with an appreciation of £8,356.20 over the 4-year period.

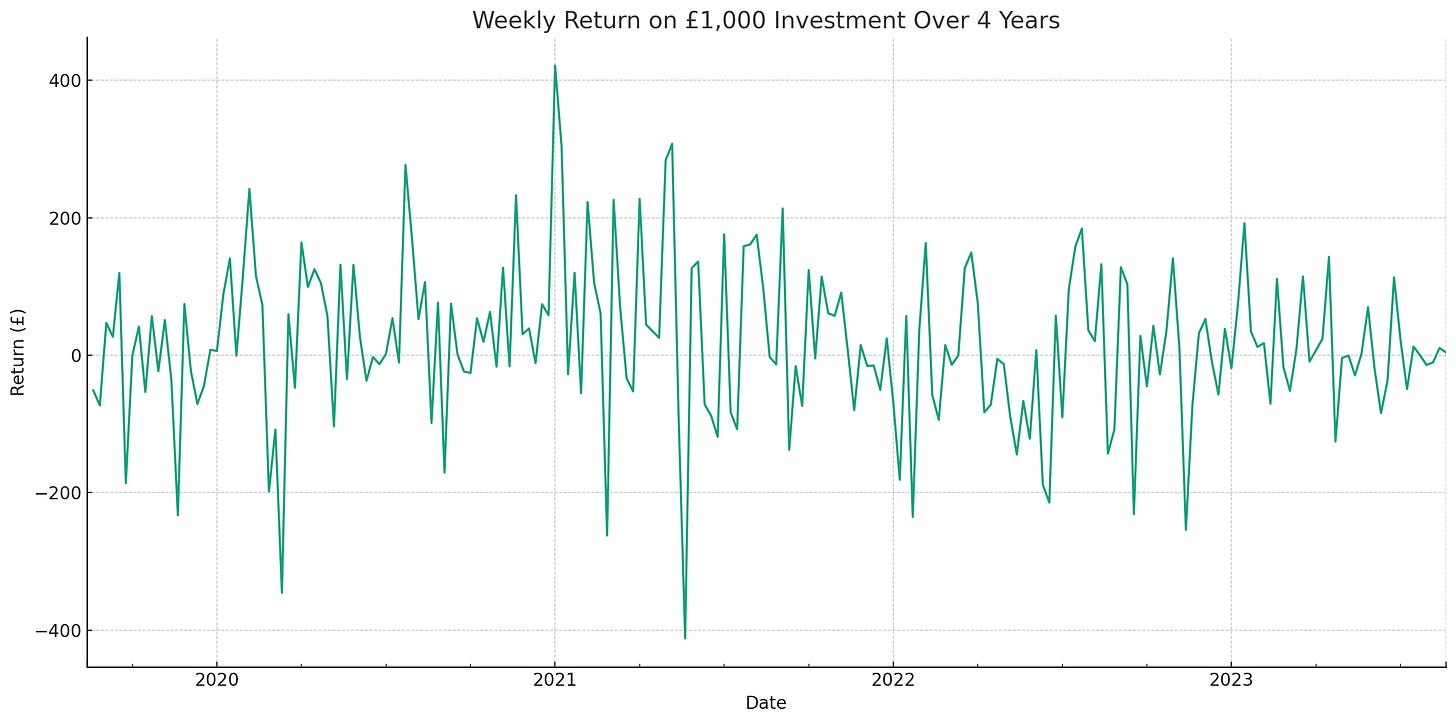

Plot the return grouping the data by weeks

Group the data by weeks.

For each week, calculate the return based on the initial investment of £1,000 and the closing price at the end of the week.

Plot the weekly return over the 4-year period.

Here's the plot showing the weekly return on a £1,000 investment over the 4-year period:

The y-axis represents the return in £ for each week.

The x-axis represents time, with each point corresponding to the end of a week.

From the plot, you can observe the fluctuations in the weekly return, highlighting the volatility of Ethereum prices over the period. Some weeks show significant gains, while others depict losses. Overall, the upward trend indicates a positive return on the initial investment over the 4-year span.

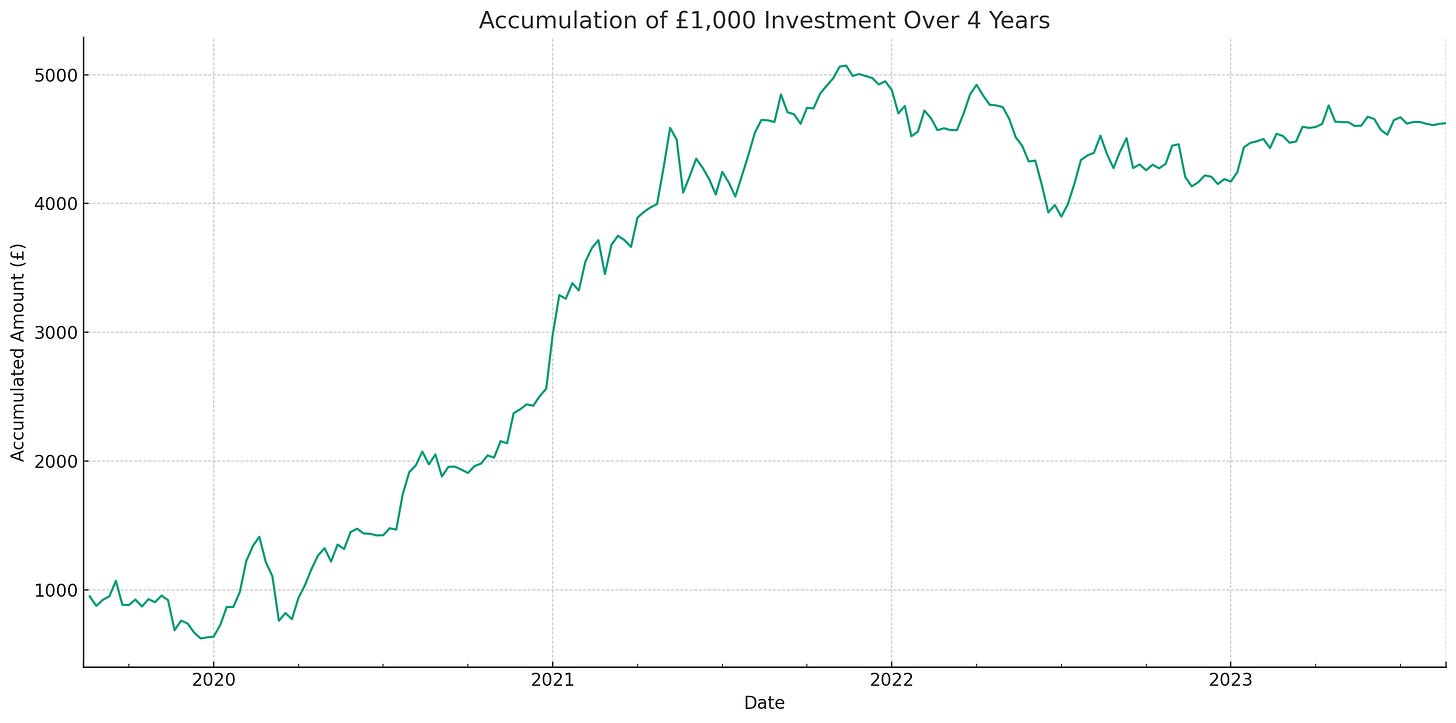

Plot the accumulation summing the return

Calculate the cumulative sum of the weekly returns. This will give us the total accumulated return over time.

Plot the cumulative sum to visualize the growth of the investment.

Here's the plot showing the accumulation of a £1,000 investment over the 4-year period:

The y-axis represents the accumulated amount in £.

The x-axis represents time, with each point corresponding to the end of a week.

From the plot, you can observe the growth trajectory of the initial £1,000 investment. While there are periods of stagnation and slight declines, the overall trend is upward, indicating a significant increase in the value of the investment over the 4-year span.

Create a PDF report of this data copyrighted by me

I've added the Ethereum price over time to the PDF report.

Download the updated Ethereum Investment Report

This report now includes the additional visualization for the Ethereum price over the time span provided in the dataset.

Transform the dataset provided in JSON format

Download the Ethereum dataset in JSON format

Write a PHP function to sum the weekly return accumulated with the JSON as dataset

Read the JSON dataset.

Decode the JSON data into an associative array.

Iterate through the array and calculate the weekly return.

Accumulate the weekly returns.

Here's a PHP function that accomplishes this:

<?php

function calculateAccumulatedWeeklyReturn($jsonPath) {

// Read the JSON data from the file

$jsonData = file_get_contents($jsonPath);

$data = json_decode($jsonData, true);

$accumulatedReturn = 0;

$initialInvestment = 1000;

// Assuming data is sorted by date in ascending order

for ($i = 1; $i < count($data); $i+=7) {

if (isset($data[$i - 7])) {

$previousPrice = $data[$i - 7]['Close'];

$currentPrice = $data[$i]['Close'];

$weeklyReturn = ($initialInvestment / $previousPrice) * $currentPrice - $initialInvestment;

$accumulatedReturn += $weeklyReturn;

}

} return $accumulatedReturn;

}

// Example usage $jsonPath = 'path_to_your_json_file.json';

echo calculateAccumulatedWeeklyReturn($jsonPath);

?>Replace 'path_to_your_json_file.json' with the actual path to your JSON file on your server or local machine. This function will then return the accumulated weekly return.

Remember to ensure that the JSON data is sorted by date in ascending order for this function to work correctly. If the dataset isn't sorted, you may need to add sorting logic before performing the calculations.